(This post is incomplete, but I’m leaving the stub here and available until I can get around to finishing it.0

deCODE Genetics formally filed for bankruptcy on November 16, 2009 — what we in the U.S. sometimes refer to as a “Chapter 11 proceeding,” after the portion of the U.S. Code of Regulations that governs these matters. But to understand deCODE’s case we have to be a little more precise: it was a Chapter 11, Section 363 proceeding — a type of bankruptcy that, as we’ll see, became especially popular during this period. Many Chapter 11 proceedings can take years to unwind and “roll-up,” and get very messy and ugly in the process; a 363 bankruptcy usually only takes a few months, and the outcome can be relatively predictable and even profitable, for those in the right position.

We also tend to think that a bankruptcy is kind of the end of the story — I know I did, when it came to deCODE. But in fact it’s better viewed as…well, I’ll let some bankruptcy experts explain it:

“The underlying reason for the practical success of today’s [363] bankruptcy sale process is that it enables a bankruptcy court to approve a transaction that achieves one of the most fundamental goals of the Chapter 11 reorganization process: to expeditiously and effectively separate a business’ past problems from its future prospects.”(ROBERT G. SABLE, MICHAEL J. ROESCHENTHALER, and DANIEL F. BLANKS, McGuirewoods LLP, “When the 363 Sale Is the Best Route” emphasis added.)

So this is not the story of deCODE’s demise; it’s the story of how its previous corporate life was “expeditiously and effectively” separated from its life-to-come. Another way of saying it: deCODE banked hundreds of millions of dollars on promises it made, and lost it all; the 363 bankruptcy proceedings described in this installment wiped that slate clean, allowing it to make an entirely new set of promises, “prospects.” Another way of saying it: zombie corporate vikings and their zombie corporations never really die. They may not be alive, but they always have future prospects. And that, as we’ll see, can be quite lucrative.

The problem is: they also leave a lot of bodies lying around in the process.

χχ

Before getting into some of the details of deCODE’s 363 bankruptcy sale, let’s learn a little more about 363 proceedings in general, and their increasing frequency in this period.

There has long been the possibility for selling off a bankrupt corporation’s assets before fully completing legal proceedings. To understand how an asset like DNA samples was treated in a 2009 bankruptcy, we should consider some history involving fashionable handkerchiefs:

“The history stretches back to the Bankruptcy Act of 1867, which permitted a sale of a debtor’s property prior to final liquidation. Congress stated: ‘‘[W]hen it appears . . . that the estate of the debtor, or any part thereof, is of a perishable nature or liable to deteriorate in value, the court may order the same to be sold, in such manner as may be most expedient . . . .’’

The Bankruptcy Act of 1898 did not include a specific provision permitting pre-adjudication sales of a debtor’s property. However, General Order in Bankruptcy No. XVIII maintained the requirements for sales when the property was perishable or liable to deteriorate in value. Over the next 40 years, the Second Circuit approved, inter alia, a private, pre-adjudication sale of a debtor’s fashionable handkerchiefs at a price above appraised value and at a time when the value of the handkerchiefs would decline greatly at the end of the holiday shopping season. The Second Circuit’s decision in this case, and several other cases, established that the concept of ‘‘perishable’’ included not just physically perishable assets, but also property ‘‘liable to deteriorate in price and value.”

…In 1978 Congress approved the Bankruptcy Code, including Section 363(b). Section 363 does not include the ‘‘perishability’’ or deterioration standards, or any requirement to show ‘‘cause,’’ thereby providing debtors “easier access’’ to Section 363(b) relief.”

DOUGLAS S. MINTZ AND MICHAEL A. STEVENS (CADWALADER, WICKERSHAM & TAFT LLP), “So You Want to Sell (or Buy) A Company Under Section 363? Here’s How,” Bankruptcy Law Reporter, 24 BBLR 1526, 11/22/2012. Copyright 2012 by The Bureau of National Affairs, Inc.

Mintz and Stevens point out that, in the ten years between 1990-2000, less than 4 percent of large, public company bankruptcies were processed through a 363 sale. But “with companies facing significant distress due to vast over-leverage,” in the decade from 2001-2010 “that figure rose to nearly 20 percent – peaking in 2011 when 43 percent of large public cases were resolved by an asset sale.”

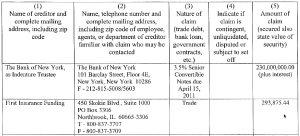

In their bankruptcy filing, deCODE had to list its top 20 creditors. The first entry is amusing, in a shocking kind of way — the $230 million debt to the Bank of New York dwarves all the remaining entries, and even just the next entry on the list by a factor of 1,000: